UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities

(Amendment No. )

| Filed by the Registrant x | Filed by a Party other than the Registrant ¨ |

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

PAR Technology Corporation

(Name of Registrant as Specified in Itsits Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i) |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| Fee paid previously with preliminary |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid: | |

| (2) | Form, Schedule, or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

PAR Technology Corporation 8383 Seneca Turnpike New Hartford, NY 13413 | |

|

April 11, 2014

Dear Shareholders:

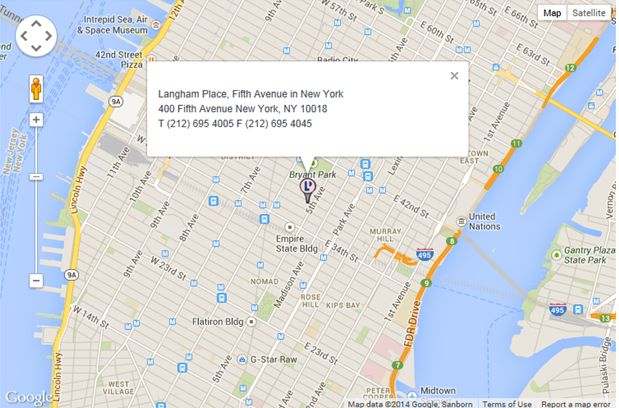

I am pleased to attendinvite you to PAR Technology Corporation's 2014Corporation’s 2021 Annual Meeting of Shareholders (the “Meeting”)Stockholders, to be held on Thursday, May 22, 2014,Friday, June 4, 2021 at 10:00 AM,a.m. (Eastern Time). In light of the COVID-19 outbreak, the protocols that federal, state, and local time. We are proud to once again holdgovernments have imposed and may impose, and in the Meeting at onebest interests of the health and well-being of our customer locations, Langham Place, Fifth Avenue, 400 Fifth Avenue, New York, New York 10018. Duringstockholders, employees and directors, the Annual Meeting we will presentbe a report on our operations, followed by discussion ofcompletely virtual meeting; there will be no physical meeting location.

You will be able to attend and voting onparticipate in the matters set forthvirtual Annual Meeting via the Internet at www.virtualshareholdermeeting.com/PAR2021, where you will be able to vote your shares electronically and submit questions. Information about how to attend and participate in the virtual Annual Meeting is included in the accompanying proxy materials.

The attached Notice of 2014 Annual Meeting of ShareholdersStockholders and Proxy Statement and discussion of otherdescribe the formal business matters properly brought before the Meeting. Therethat we will also be time for questions.

Your vote is not permitted to vote on your behalf in an uncontested election of directors or corporate governance matters supported by management unless you provide specific instructions. As a result, taking an active role in the voting of your shares has become more important than ever before.. Whether or not you plan to attend you can ensurethe virtual Annual Meeting, please vote your shares are represented at the Meeting by promptly voting and submitting your proxy overtelephone, by the Internet by telephone, or, if you received a printed copy of the proxy materials, by completing, signing and dating your proxy card and returning your proxy formit in the prepaid envelope provided withprovided. Voting by proxy now will not limit your right to change your vote or to attend the form.

On behalf of the Board of Directors, I would like to express our appreciation for your continued support, interest and investment in PAR Technology Corporation.

Sincerely,

Savneet Singh, Chief Executive Officer and& President

PAR Technology is concerned about our environment and preserving our world's natural resources. If you are accessing this document on line, please consider the environment before you print. If you are reviewing a hard copy of this document, when you are finished, please be considerate of the environment and recycle.

8383 Seneca Turnpike, New Hartford, NY 13413-4991

NOTICE OF 2014

2021 ANNUAL MEETING OF SHAREHOLDERS

Dear PAR Technology Shareholder:

The 20142021 Annual Meeting of ShareholdersStockholders (the "Meeting"“Annual Meeting”) of PAR Technology Corporation, a Delaware corporation (the “Company”, “PAR”, “we”, “us”, or “our”), will be held at one of our customer locations, Langham Place, Fifth Avenue, 400 Fifth Avenue, New York, New York 10018 on Thursday, May 22, 2014, at 10:00 AM, local time, for the following purposes:

| Date: | |

| Time: | 10:00 a.m. (Eastern Time). |

| Virtual Meeting: | In light of the COVID-19 pandemic, the protocols that federal, state, and local governments have imposed and may impose, and in the best interests of the health and well-being of our stockholders,employees and directors, the Annual Meeting will be a completely virtual meeting; there will be no physical meeting location. |

| To attend and participate in the Annual Meeting, if you are a registered holder, you will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials or on your proxy card. If you are a beneficial owner and your shares are registered in the name of a broker, bank, or other nominee and your voting instruction form or Notice of Internet Availability of Proxy Materials indicates that you may vote those shares through the http://www.proxyvote.com website, then you may attend and participate in the Annual Meeting using the 16-digit control number included on that instruction form or notice. Otherwise, beneficial owners should contact their broker, bank or other nominee (preferably at least five days before the Annual Meeting) and obtain a “legal proxy” in order to be able to attend and participate in the Annual Meeting. Stockholders will be able to vote and submit questions during the Annual Meeting. | |

| Place: | Virtual-only via the Internet at www.virtualshareholdermeeting.com/PAR2021. |

| Record Date: | April 9, 2021. |

| Items of Business: | To elect the five Director nominees named in the accompanying Proxy Statement to serve until the 2022 annual meeting of stockholders; |

| To approve, on a non-binding, advisory basis, the compensation of our named executive officers; | |

| To approve our 2021 Employee Stock Purchase Plan; | |

| To approve the issuance of up to 253,233 shares of common stock upon exercise of the Assumed Unvested Options; | |

| To approve the issuance of up to 280,428 shares of common stock upon exercise of the Warrant; | |

| To ratify the appointment of |

| To transact |

A complete list of registered stockholders will be available at least 10 days prior to the Annual Meeting at our corporate headquarters, 8383 Seneca Turnpike, New Hartford, New York 13413. This list will also be available to stockholders of record during the Annual Meeting for examination at www.virtualshareholdermeeting.com/PAR2021.

| Important Notice Regarding the Availability of Proxy Materials for | ||

| the Annual Meeting of Stockholders to Be Held on Friday, June 4, 2021 at 10:00 a.m. (Eastern Time). | ||

| This Notice of 2021 Annual Meeting of Stockholders, Proxy Statement, and 2020 Annual Report on Form 10-K are available at www.proxyvote.com. | ||

By Order of the Board of Directors,

| Savneet Singh, | |

| Chief Executive Officer and President |

New Hartford, New York

April [●], 2021

Whether or not you plan to attend the virtual Annual Meeting, please vote your shares by telephone, by the Internet or, if you received a printed copy of the proxy materials, by completing, signing and dating your proxy card and returning it in the envelope provided. Voting by proxy now, will not limit your right to change your vote or to attend the virtual Annual Meeting.

TABLE OF CONTENTS

| 2021 Employee Stock Purchase Plan | Appendix A-1 |

| i |

PAR Technology Corporation

8383 Seneca Turnpike

New Hartford, NY 13413-4991

April [●], 2021

2021 ANNUAL MEETING OF STOCKHOLDERS

To be held June 4, 2021

This Proxy Statement is being furnished to the stockholders of PAR Technology Corporation, a Delaware corporation, in connection with the solicitation of proxies by our Board of Directors setfor use at our 2021 Annual Meeting of Stockholders to be held on Friday, June 4, 2021 at 10:00 a.m. (Eastern Time) virtually via the Internet at www.virtualshareholdermeeting.com/PAR2021. This Proxy Statement and proxy card or Notice of Internet Availability of Proxy Materials are first being sent or made available to our stockholders on or about April 2, 2014 as[●], 2021.

Information About the Proxy Materials and Voting

Who is entitled to notice and to vote at the Annual Meeting?

Only stockholders of record date for the Meeting. This means that owners of the Company's Common Stockour common stock at the close of business on April 2, 2014 are entitled to receive this notice and to vote at9, 2021, the Meeting or any adjournments or postponements thereof. A list of shareholders as of the close of business on April 2, 2014 will be made available for inspection by any shareholder, for any purpose relating to the Meeting, during normal business hours at our principal executive offices, PAR Technology Park, 8383 Seneca Turnpike, New Hartford, New York 13413, beginning 10 days prior to the Meeting. This list will also be available to shareholders at the Meeting.

Distribution of Proxy Materials; Notice of Internet Availability of Proxy Materials (the “Notice”).

As permitted by the Meeting including the electionrules of the Directors. The holdersSecurities and Exchange Commission (“SEC”), on or about April [●], 2021, we sent the Notice to our stockholders as of shares representingApril 9, 2021. Stockholders will have the ability to access the proxy materials, including this Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2020, on the Internet at www.proxyvote.com or to request a majority,printed or ________ votes, represented in person or by proxy, shall constitute a quorum to conduct business.

Who is paying for this proxy solicitation?

We are paying the Meeting. costs of the solicitation of proxies. We will reimburse brokers, banks or other custodians, nominees and fiduciaries for their charges and expenses in forwarding proxy materials to beneficial owners. Certain of our Directors, officers and employees, without additional compensation, may also solicit proxies on our behalf in person, by telephone, or by electronic communication. In addition, we have engaged Morrow Sodali LLC to assist in the solicitation from brokers, bank nominees and institutional holders for a fee of $8,000 plus out-of-pocket expenses.

Stockholder of Record; Shares Registered in Your Name.

If on April 9, 2021 your shares were registered directly in your name, then you are a beneficial shareholder, please referstockholder of record and you may vote on the matters to be voted upon at the Annual Meeting. If your proxy card or the information forwarded to you by your bank, broker or other holder of record to identify which options are available to you. If you take advantage of telephone or Internet voting, you do not need to return your proxy card. Telephone and Internet voting facilities for shareholders of record will be available 24 hours a day, and will close at 3:00 AM on May 22, 2014.

| 1 |

Beneficial Owners; Shares Registered in the Name of a Broker, Bank, or Other Nominee.

If on April 9, 2021 your shares were not registered in your name, but rather in the name of a broker, bank, or other nominee, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization, which is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank, or other nominee regarding how to vote your shares. You are also invited to attend the Annual Meeting. Beneficial owners whose voting instruction form or the Notice indicates that they may vote their shares through the http://www.proxyvote.com website may attend and participate in the Annual Meeting using the 16-digit control number included on that instruction form or the Notice. Otherwise, beneficial owners should contact their broker, bank or other nominee (preferably at least 5 days before the Annual Meeting) and obtain a “legal proxy” in order to be able to attend and participate in the Annual Meeting. If you have any questions about your control number or how to obtain one, please contact the broker, bank or other nominee that holds your shares.

Participating in the Virtual Annual Meeting.

This year, the Annual Meeting will be a completely virtual meeting. There will be no physical meeting location.

The meeting will be conducted via an audio webcast. To participate in the virtual Annual Meeting, visit www.virtualshareholdermeeting.com/PAR2021 and enter the 16-digit control number included on your Notice or on your proxy card or the voting instruction form, or otherwise provided to you by your broker, bank or other nominee, as described above. You may begin to log into the meeting platform beginning at 9:45 a.m., Eastern Time, on June 4, 2021. The Annual Meeting will begin promptly at 10:00 a.m., Eastern Time, on June 4, 2021.

If you wish to submit a question during the meeting, log into the virtual meeting platform at www.virtualshareholdermeeting.com/PAR2021, type your question into the “Ask a Question” field, and click “Submit.” We will endeavor to answer as many questions submitted by stockholders as time permits. We reserve the right to edit profanity or other inappropriate language and to exclude questions regarding topics that are not pertinent to meeting matters or company business. If we receive substantially similar questions, we may group such questions together and provide a single response to avoid repetition.

Matters to be voted on at the Annual Meeting.

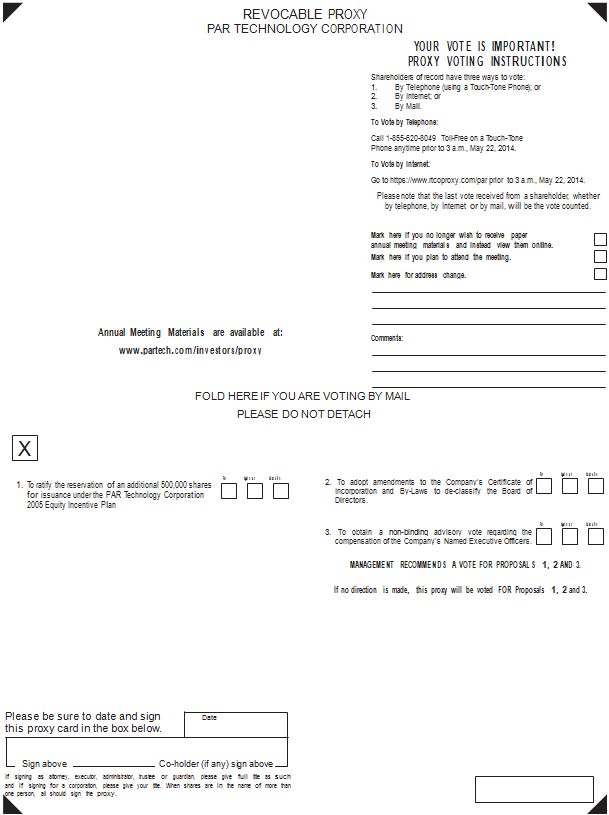

We are asking our stockholders to consider and vote on the following matters:

| · | Proposal 1: | Election of the five Director nominees named in this Proxy Statement to serve until the 2022 Annual Meeting of Stockholders; | |

| · | Proposal 2: | Approval, on a non-binding, advisory basis, of the compensation of our named executive officers; | |

| · | Proposal 3: | Approval of the 2021 Employee Stock Purchase Plan; | |

| · | Proposal 4: | Approval of the issuance of up to 253,233 shares of common stock upon exercise of the Assumed Unvested Options; | |

| · | Proposal 5: | Approval of the issuance of up to 280,428 shares of common stock upon exercise of the Warrant; | |

| · | Proposal 6: | Ratification of the appointment of Deloitte & Touche LLP as our independent auditors for 2021; and |

| 2 |

| · | Other business, if properly raised. |

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, the individuals named on the proxy card will vote your shares in their discretion on such matters.

How do I vote my shares?

Stockholders may vote their shares over the Internet, by telephone or during the Annual Meeting by going to www.virtualshareholdermeeting.com/PAR2021. If you requested and/or received printed proxy material, including a printed version of the shareholder. In those instances where proxy cardscard, you may also vote by mail.

| · | By Internet (before the Annual Meeting). You may vote at www.proxyvote.com, 24 hours a day, seven days a week. You will need the 16-digit control number included on your Notice or on your proxy card or the voting instruction form. Votes submitted through the Internet must be received by 11:59 p.m., Eastern Time, on June 3, 2021. If you are a beneficial owner, the availability of online voting may depend on the voting procedures of the organization that holds your shares. |

| · | By Telephone. You may vote using a touch-tone telephone by calling 1-800-690-6903, 24 hours a day, seven days a week. You will need the 16-digit control number included on your Notice or on your proxy card or the voting instruction form. Votes submitted by telephone must be received by 11:59 p.m., Eastern Time, on June 3, 2021. If you are a beneficial owner, the availability of phone voting may depend on the voting procedures of the organization that holds your shares. |

| · | By Mail. If you received printed proxy materials, you may submit your vote by completing, signing and dating the proxy card received and returning it in the prepaid envelope. |

| · | During the Annual Meeting. You may vote during the virtual Annual Meeting by going to www.virtualshareholdermeeting/PAR2021.com. You will need the 16-digit control number included on your Notice or on your proxy card or the voting instruction form or otherwise provided to you by your broker, bank or other nominee, as described above. If you previously voted via the Internet (or by telephone or mail), you will not limit your right to vote online at the Annual Meeting. |

Can I change my vote after submitting my proxy?

Yes, if you are signed and returned, but fail to specify the shareholder's voting instructions, the shares represented by thata stockholder of record, you can revoke your proxy will be voted as recommended by the Board of Directors. The proxy solicited hereby may be revoked at any time prior to its exercise by: (i) executing and returning to the address set forth above a proxy bearing a later date; (ii) voting on a later date via telephone or Internet; (iii) giving written notice of revocation to the Secretary of the Company at the address set forth above;Annual Meeting by:

| · | Submitting another completed and signed proxy card bearing a later date; |

| · | Granting a subsequent proxy by telephone or through the Internet; |

| · | Giving written notice of revocation to PAR Technology Corporation’s Corporate Secretary; and |

| · | Attending the virtual Annual Meeting and voting by following the instructions described in this Proxy Statement. Simply attending the virtual Annual Meeting will not, by itself, revoke your proxy. |

Your most current vote will be counted. If you are a beneficial owner of shares registered in the name of a broker, bank, or (iv) voting atother nominee, you will need to follow the Meeting.

What constitutes a Shareholder may: (i) vote “FOR”, (ii) vote “AGAINST” or (iii) “ABSTAIN” from voting. quorum?

A majority of the votes cast by the holders of shares of capitalour common stock present or represented by proxyoutstanding and entitled to vote thereon (aon April 9, 2021 must be present at the Annual Meeting to constitute a quorum being present) is requiredand to ratifyconduct business at the amendment of the 2005 Equity Incentive Plan.Annual Meeting. For this proposal, abstentions and broker “non-votes” are included in the number of shares present or represented for purposes of determining whether a quorum exists, butshares represented by proxy and in attendance online at the Annual Meeting, as well as any abstentions and broker non-votes will be counted for purposes of establishing a quorum. An “abstention” occurs when a stockholder affirmatively declines to vote on a proposal. A broker non-vote occurs when shares held by a broker, bank or other nominee in “street name” are not considered as shares voting or as votes castvoted with respect to such matter. As a result, abstentions and broker “non-votes” willone or more proposals because the nominee did not have any effect on such proposals.

| 3 |

What vote is required to approve each proposal?

| Proposal | Voting Options | Vote Required | Effect of Votes | |

| 1 | Election of Directors | “For” or “Withhold” | A plurality of votes cast (which means the five Director nominees receiving the most “For” votes will be elected) | “Withhold” votes and broker non-votes will have no effect on the results. |

| 2 | Advisory Vote to Approve the Compensation of our Named Executive Officers | “For”, “Against” or “Abstain” | A vote “For” by a majority of votes cast | Abstentions and broker non-votes will have no effect on the results. This advisory vote on executive compensation is non-binding on the Board. |

| 3 | Approval of our 2021 Employee Stock Purchase Plan | “For”, “Against” or “Abstain” | A vote “For” by a majority of votes cast | Abstentions will have the same effect as a vote against the proposal. Broker non-votes will have no effect on the results. |

| 4 | Approval of the issuance of up to 253,233 shares of common stock upon exercise of the Assumed Unvested Options | “For”, “Against” or “Abstain” | A vote “For” by a majority of votes cast | Abstentions will have the same effect as a vote against the proposal. Broker non-votes will have no effect on the results. |

| 5 | Approval of the issuance of up to 280,428 shares of common stock upon exercise of the Warrant | “For”, “Against” or “Abstain” | A vote “For” by a majority of votes cast | Abstentions will have the same effect as a vote against the proposal. Broker non-votes will have no effect on the results. |

| 6 | Ratification of Deloitte & Touche LLP as our Independent Auditors for 2021 | “For”, “Against” or “Abstain” | A vote “For” by a majority of votes cast | Abstentions will have no effect on the results of the vote. Brokers, banks and other nominees have discretionary authority to vote on this proposal. |

What if I return a proxy card but do not make specific choices?

All properly signed proxies returned in time to be counted at the Annual Meeting will be voted by the named proxies at the Annual Meeting. Where you have specified how your shares should be voted on a matter, your shares will be voted in accordance with your instructions; if you properly sign your proxy card, but you do not indicate how your shares should be voted on a matter, your shares will be voted as the Board recommends. The Board recommends a vote “For” the five Director nominees identified in Proposal 1 and “For” Proposals 2-6.

| 4 |

What is “householding” and how does it work?

If you are the beneficial owner of Common Stock representedshares held in person“street name”, the broker, bank, or other nominee that holds your shares may deliver a single Proxy Statement and Annual Report on Form 10-K, along with individual proxy cards, or individual voting instruction forms to any household at which two or more stockholders reside unless contrary instructions have been received from you. This procedure, referred to as householding, reduces the volume of duplicate materials stockholders receive and reduces mailing expenses. Stockholders may revoke their consent to future householding mailings or enroll in householding by contacting Broadridge Financial Solutions by calling 1-866-540-7095, or by writing to Broadridge Financial Solutions, 51 Mercedes Way, Edgewood, New York 11717, Attn: Householding Department. If you wish to receive a separate set of proxy and entitledmaterials for this year’s Annual Meeting, we will deliver them promptly upon request to Attn: Investor Relations, PAR Technology Corporation, 8383 Seneca Turnpike, New Hartford, New York 13413 or (315) 738-0600.

Proposal 1 – Election of Directors

At the Annual Meeting stockholders will vote to elect five Directors to serve until the 2022 annual meeting of stockholders. All Director nominees have been nominated by the Board based on the proposal will be required for approval.

Director Nominees

The following table sets forth information furnished to shareholders. The Company will also bear the cost of the charges and expenses of brokerage firms and others forwarding the solicitation material to beneficial owners of shares of the Company's Common Stock. The Internet and telephone voting procedures are designed to verify a shareholder's identity, allow the shareholder to give voting instructions and confirm that such instructions have been recorded properly.

| Continuing Directors | Age | Director Since | Term Will Expire |

| Ronald J. Casciano | 60 | 2013 | 2015 Annual Meeting of Shareholders |

| Dr. John W. Sammon | 75 | 1968 | 2015* Annual Meeting of Shareholders |

* In the event the proposal to de-classify the Board fails to pass, Dr. Sammon's term will expire at the 2016 Annual Meeting of Shareholders | |||

Director | Age | Director Since | Positions and Offices | Independent(1) | ||||

| Savneet Singh | 37 | 2018 | Chief Executive Officer and President of the Company and President of ParTech, Inc. | No | ||||

| Keith E. Pascal | 56 | 2021 (April) | Yes | |||||

| Douglas G. Rauch | 69 | 2017 | Yes | |||||

| Cynthia A. Russo | 51 | 2015 | Yes | |||||

| James C. Stoffel | 75 | 2017 | Yes |

(1) Independent under the listing standards of the New York Stock Exchange ("NYSE"),(NYSE) and our Corporate Governance Guidelines.

The Board of Directors unanimously recommends a vote “For” the Company's Standardselection of Independence,each of the above Director nominees.

| 5 |

Directors and pursuantDirector Nominees

Below are summaries of the background, business experience and description of the principal occupation of each Director and Director nominee.

Keith E. Pascal. Mr. Pascal has served as a director of BJ’s Restaurants, Inc. since May 2020. Since March 2018, Mr. Pascal has served as a Partner at Act III Holdings, LLC, a Boston-based investment fund, and since 2008, he has served as President and Founder of 12:51:58 MW LLC, a provider of an enterprise software platform for global restaurant and retail operators. From January 2015 to March 2018, Mr. Pascal worked for Panera Bread where he served as a consultant and was named Chief Concept Officer in November 2017. Mr. Pascal served as CEO of Goji, a developer of high-tech cooking technology, from 2010 to 2012, as the CEO of Torex Retail PLC Hospitality Division from 2006 to 2008, and as Founder and CEO of Savista, a point of sale software and business process outsourcing company serving the global restaurant industry, from 1999 to 2006. Mr. Pascal started his career in operations at McDonald’s Corp. Mr. Pascal brings over 20 years of restaurant operations and executive experience, with both privately-held and publicly-held national restaurant chains, and significant experience in the restaurant industry, as both an investor and as a director.

Douglas G. Rauch. Mr. Rauch spent 31 years with Trader Joe’s Company, the last 14 years as a President until his retirement in June 2008. Since June 2015, Mr. Rauch has served as the Founder/President of Daily Table, an innovative non-profit retail solution to bring affordable nutrition to the Company'sfood insecure in Boston’s inner city. He previously served as CEO of Conscious Capitalism, Inc. from August 2011 to July 2017, where he continues to serve as a director. Since February 2020, Mr. Rauch has served as a director of Sprouts Farmers Market, Inc. (NASDAQ: SFM), a grocery store offering affordable, fresh, natural and organic products, where he serves as the Chair of the Audit Committee. From October 2009 to October 2019, Mr. Rauch served as a trustee at the Olin College of Engineering and he serves as a director or as an advisory board member of several for profit and non-profit companies. Mr. Rauch brings extensive knowledge and operational experience in the food service/grocery industry and strategic implementation and leadership skills providing insights and perspectives important to us as a provider of technology solutions to restaurants and retail.

Cynthia A. Russo. Ms. Russo has more than 25 years of experience in financial and operations management with global, growth technology companies. Since June 2019, Ms. Russo has served as a director of Verra Mobility Corporation (NASDAQ: VRRM), a provider of smart mobility technology solutions and services throughout the United States, Canada and Europe, where she serves on the Audit and Compensation Committees. Since 2021, Ms. Russo has served as director of UserTesting, Inc., an on-demand human insight platform that enables organizations to deliver a better customer experience, where she serves as the chair of the Audit Committee. Ms. Russo is also a director of Verifone, Inc., a global unified platform that provides customers a seamless payment experience with any payment method, where she serves as the Audit Committee chair. Ms. Russo previously served as the lead director at the Company from 2015 to 2019. Ms. Russo previously served as Executive Vice President and Chief Financial Officer of Cvent, Inc. (NYSE: CVT), a cloud-based enterprise event management platform, from September 2015 to September 2018. Prior to that, Ms. Russo served as Executive Vice President and CFO of MICROS Systems, Inc., a global, public enterprise information system software, hardware and services company for retail and hospitality industries (NASDAQ: MCRS). During her 19 years at MICROS, Ms. Russo served in a variety of senior financial roles until MICROS Systems’ acquisition by Oracle in September 2014. Ms. Russo holds a bachelor’s degree in business administration from James Madison University and is a Certified Public Accountant and Certified Internal Auditor. Ms. Russo brings significant financial accounting expertise, executive leadership and operational and risk management experience to our Board.

| 6 |

Savneet Singh. Mr. Singh’s biographical information is set forth below under “Compensation Discussion and Analysis.”

James C. Stoffel. From 2006 Mr. Stoffel has been a senior advisor to private equity and board member of multiple public companies. From 2011 to 2019 he also served as Co-Founding General Partner of Trillium International, a private equity firm focused on growth equity investments in technology companies. From 1997 – 2005, Mr. Stoffel held various senior executive positions at Eastman Kodak Company, including as Senior Vice President, Chief Technical Officer; Director of Research and Development; and Vice President, Director Electronic Imaging Products Research and Development. Prior to Eastman Kodak Company, Mr. Stoffel had a 20-year career with Xerox Corporation, serving as Vice President of Corporate Governance Guidelines. In orderResearch and Technology; Vice President and General Manager of Advanced Imaging Business Unit; Vice President and Chief Engineer; and other executive positions. Since January 2007, Mr. Stoffel has served on the board of directors of Aviat Networks, Inc. (NASDAQ:AVNW), where he chairs the Compensation Committee and previously served as a lead independent director from July 2010 to assistFebruary 2015. From 2003 until his retirement in October 2018, Mr. Stoffel served on the Board in making this determination,of Directors of Harris Corporation (NYSE: HRS, now L3 Harris Technologies, Inc. (NYSE: LHX)). Mr. Stoffel is a Life Fellow of the Institute of Electrical and Electronics Engineers and Trustee Emeritus of the George Eastman Museum. Mr. Stoffel’s technology management expertise, his general management experience, his investment and capital markets expertise, and his extensive public company board experience, provides us with valuable perspectives, capabilities, and knowledge critical to our strategy, management, and corporate governance. Mr. Stoffel serves as Lead Director of the Board of Directors of the Company.

Director Independence. Each of our Directors, other than Savneet Singh, has adoptedbeen determined by the Board to be “independent” under the listing standards of the New York Stock Exchange (“NYSE”) and meets the additional independence as partstandards of the Company's Corporate Governance Guidelines,NYSE with respect to the Board committees on which he or she serves. Our independent Directors are availableidentified as “Independent” in the table on the Company's website at http://www.partech.com/wp-content/uploads/2012/01/PAR_Corp_Gov_Guidelines.pdf. These standards identify, among other things, material business, charitable and other relationships that could interfere with a Director's ability to exercise independent judgment. During 2013, there were no transactions, relationships or arrangements between the Company and Directors Ahn, Jost or Simms or anypage 5 of their respective immediate family members or entities with which they are affiliated. There are no family relationships between any of these Directors and any of the Company's executive officers ("Executive Officers"). The Executive Officers serve at the discretion of the Board.

Board Meetings and Attendance.

Board Leadership Structure.

Board Oversight of Risk Management.

| 7 |

Code of Conduct. Our Code of Conduct (the “Code of Conduct”) is applicable to all four standing committees until such time as the open seatsour employees, officers, and Directors, including our Chief Executive Officer, Chief Financial Officer, and other senior financial officers. The Code of Conduct is posted on the Board have been duly filled. For those committees where independence is required of all members, any non-independent directors sitting on such committees shall resign from such committees as soon as reasonably practicable after the appointment of independent directors.

| Name | Executive | Audit | Compensation | Nominating and Corporate Governance |

| Mr. Ahn | Chair | Chair | X | X |

| Mr. Jost | X | X | Chair | X |

| Dr. Sammon | X | |||

| Mr. Simms | X | X | Chair | |

| 2013 Meetings | 0 | 6 | 6 | 7 |

Hedging Transactions. Our Compliance Handbook, which applies to all our employees, officers and Directors prohibits hedging or monetization transactions in our securities, including through the use of financial instruments such as prepaid variable forwards, equity swaps, collars and exchange funds that permit holders to own our securities without the full risks and rewards of ownership.

Corporate Governance Guidelines. Our Corporate Governance Guidelines are posted on our website at www.partech.com/about-us/investor-relations/. Our Corporate Governance Guidelines contain independence standards, which are substantially similar to and consistent with the listing standards of the General Corporation Law of the State of Delaware; the Company's Certificate of Incorporation;NYSE, and the Company's By-Laws,policies relating to exercise all powers of the Board in the management and direction of the business and affairs of the Corporation in all cases in which specific direction has not been provided by the Board. The Executive Committee meets when required on short notice during intervals between meetings of the Board.

Communication with the Board.

Committees. Our Board has three committees — Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. Each Board committee operates under a written charter that has been approved by the Board. Current copies of each committee’s charter are posted on our website at www.partech.com/about-us/investor-relations/.

The following table provides information about each of the Board committees. Mr. Pascal, who was appointed to the Board effective April 8, 2021 following the completion of the Private Placement, has not yet been given committee assignments.

| Name | Audit Committee (1) | Compensation Committee(2) | Nominating and Corporate Governance Committee(3) | |||

| Douglas G. Rauch | X | X | Chair | |||

| Cynthia A. Russo | Chair | X | X | |||

| James C. Stoffel | X | Chair | X | |||

| Total Meetings in 2020 | 7 | 6 | 3 |

(1) Committee members are independent under the listing standards of the NYSE, Rule 10A-3 of the Securities Exchange Act of 1934 (“Exchange Act”), and as defined in the Audit Committee’s charter.

(2) Committee members are independent under the listing standards of the NYSE and as defined in the Compensation Committee’s charter.

(3) Committee members are independent under the listing standards of the NYSE and as defined in the Nominating and Corporate Governance Committee’s charter.

| 8 |

Compensation Committee. The Compensation Committee oversees and administers our executive compensation program. The Compensation Committee’s responsibilities include:

| · | Reviewing and approving the goals and objectives relevant to our Chief Executive Officer’s compensation and, either as a Committee or (to the extent applicable) with the other independent Directors, determining and approving our Chief Executive Officer’s compensation; |

| · | Reviewing, making recommendations to the Board, and overseeing the administration of our compensatory programs, including incentive compensation arrangements; |

| · | Reviewing and approving compensation of our other named executive officers; and |

| · | Reviewing and recommending to the Board the compensation for our non-employee Directors. |

The Compensation Committee has the authority to retain, oversee and compensate third party compensation consultants, legal counsel, or other advisers to assist the Committee in fulfilling its responsibilities. In 2020, the Committee engaged Pearl Meyer & Partners, LLC (“Pearl Meyer”) as its compensation consultant to assist it in recommending the form and amount of executive and non-employee Director compensation for 2020. Among other things, with respect to our 2020 compensation program, the Committee asked Pearl Meyer to:

| · | Perform an assessment as to the competitiveness of our executive compensation including total cash compensation (base salary and short-term incentive compensation (cash bonus)) and equity compensation (including structural considerations, equity components and performance matrices), relative to our peer group and broader survey data; |

| · | Advise on amendments to our long-term equity incentive plan; |

| · | Perform a non-employee director compensation review with a competitive assessment; |

| · | Review and provide guidance on the employment agreement for the Chief Executive Officer; |

| · | Present COVID-19 trends and updates, including actions or discretions being considered or adopted by the Company’s peers and the broader market; |

| · | Provide legislative and regulatory updates including reviewing annual trends; |

| · | Provide guidance on the compensation discussion and analysis, including the CEO Pay Ratio, and review of the proxy advisor reports; |

| · | Provide guidance on clawback practices and stock ownership guidelines; and |

| · | Provide additional assistance, as requested by the Committee, in analyzing and determining senior officer compensation. |

Prior to engaging Pearl Meyer, the Committee considered information relevant to confirm Pearl Meyer’s independence from the Board and management. Additional information regarding the services provided by Pearl Meyer can be found below under “Compensation Discussion and Analysis – Role of Compensation Consultant.”

| 9 |

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee assists the Board in meeting its responsibilities by:

| · | Identifying and recommending qualified nominees for election to the Board; |

| · | Developing and recommending to the Board a set of corporate governance principles — our Corporate Governance Guidelines; and |

| · | Maintaining, monitoring compliance with, and recommending modifications to, our Code of Conduct. |

Our Nominating and Corporate Governance Committee reviews possible candidates for the Board and recommends nominees to the Board for approval. The Nominating and Corporate Governance Committee considers potential candidates from many sources including shareholders,stockholders, current Directors, company officers, employees,management, and others. On occasion, the services of a third party executive search firm are used to assist in identifying and evaluating possible nominees. ShareholderStockholder recommendations for possible candidates for the Board should be sent to: Nominating and Corporate Governance Committee, c/o Corporate Secretary, PAR Technology Corporation, PAR Technology Park, 8383 Seneca Turnpike, New Hartford, NYNew York 13413. Regardless of the source of the recommendation, the Nominating and Corporate Governance Committee screens all potential candidates in the same manner. In identifying and considering candidates, the Committee considers the requirementscriteria set out in the charter of the Nominating and Corporate Governance Committee. The criteriaGuidelines, which include specific characteristics, abilities and experience considered relevant to the Company'sCompany’s businesses, including:

| · |

| · |

| · | Lack of existing and future commitments that could materially interfere with the member’s obligations to the Company; |

| · | Skills compatible with |

| · | Substantial experience outside of the business community, including in the public, academic or scientific communities; |

| · | Character and integrity; |

| · | Inquiring mind and vision; |

| · | Critical temperament; and |

| · |

In addition, to the non-exhaustive criteria set forth in the charter of the Nominating and Corporate Governance Committee the committee also considers the requirements set forth in the Company's Corporate Governance Guidelines, as well as the needs of the Company and the range of talent and experience represented on the Board. When considering a candidate, the committee will determine whether requesting additional information or an interview is appropriate. The minimum qualifications and specific qualities and skills required for a candidate are set forth in the Company's Corporate Governance Guidelines and the charter of the Nominating and Corporate Governance Committee which are posted on the Company's website. Printed copies are available,selects director candidates without charge, upon written requestregard to race, color, sex, religion, national origin, age, disability, or any other category protected by state, federal, or local law. The Nominating and Corporate Governance Committee considers issues of diversity in identifying and recommending director nominees to the Company.Board. The websiteNominating and addressCorporate Governance Committee strives to send such requests may be found underinclude a balance of diverse backgrounds, differing points of views and experience in particular fields, and believes that, collectively, the heading "Available Information" on page 31Board should represent a diversity of perspectives. The Board assesses its effectiveness in this Proxy Statement.

Audit Committee. Our Audit Committee assists the Company's business is conductedBoard in a consistentlyits oversight of the integrity of our financial statements, our compliance with legal and ethical manner, allregulatory requirements, our independent auditors’ qualifications and independence, and the performance of the Company's Directorsinternal audit function.

| 10 |

The Audit Committee’s responsibilities include:

| · | Direct oversight of our independent auditor, including appointment, compensation, evaluation, retention, work product, and pre-approval of the scope and fees of the annual audit and any other services, including review, attestation, and non-audit services; |

| · | Reviewing and discussing the internal audit process, scope of activities and audit results with internal audit; |

| · | Reviewing and discussing our quarterly and annual financial statements and earnings releases with management and the independent auditor; |

| · | Recommending to the Board that our audited financial statements be included in our Annual Reports on Form 10-K; |

| · | Overseeing and monitoring our internal control over financial reporting; |

| · | Assisting the Board in oversight of our systems, data security and compliance with legal and regulatory matters; |

| · | Reviewing and discussing with management its guidelines and policies with respect to risk assessment and risk management and our major financial risk exposures, including the nature and level of risk appropriate for the Company and management’s strategies and mitigation efforts; and |

| · | Preparing the Audit Committee report required by SEC rules (which is included below). |

The Board determined that Ms. Russo is an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K of the Exchange Act.

| 11 |

The material in this report is being furnished and employees, including the Company's principal executive officer, the principal financial officer, the principal accounting officer, controller and all other Executive Officers are required to abide by the Company's Code of Business Conduct and Ethics (the "Code"). The Code is designed to deter wrongdoing and to promote: (a) honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; (b) full, fair, accurate, timely and understandable disclosure in reports and documents that the Company filesshall not be deemed “filed” with or submits to the SEC and other public communications; (c) compliance with applicable governmental laws, rules and regulations; (d) the prompt internal reportingfor purposes of violationsSection 18 of the Code to the appropriate person(s) identified in the Code; and (e) accountability for adherence to the Code. A printed copy of the Code may be obtained without charge by making a written request to the Company. Information regarding where such requests should be directed can be found on page 31 of this Proxy Statement under the heading "Available Information". The full text of the Code is available at http://www.partech.com/wp-content/uploads/2012/01/Code_of_Business_Conduct_and_Ethics.pdf. The Company intends to disclose future amendments to,Exchange Act, or waivers from, provisions of the Code that apply to the Executive Officers and Directors and relate to the above elements by posting such information on its website within five calendar days following the date of such amendment or waiver.

To the Board and acting on behalf of and reportingDirectors of PAR Technology Corporation:

The Audit Committee is responsible for appointing the Company’s independent auditor. For 2020, Deloitte & Touche LLP (“Deloitte”) served as the Company’s independent auditor. With respect to the Board, the Audit Committee provides oversight of the financial management, independent auditors andCompany’s financial reporting process, of the Company. The Audit Committee's charter is reviewed annually for changes as appropriate and is available on the Company's website or, upon request, in hardcopy (See "Available Information" on page 31 of this Proxy Statement). Three independent members of the Board comprised the Audit Committee during 2013. The independence of the members of the Committee was determined by the Board based upon its independence standards which incorporate the New York Stock Exchange governance rules and the SEC's independence requirements for members of audit committees. In addition, the Board determined that each member of the Committee, Sangwoo Ahn, Kevin Jost and James Simms, are "audit committee financial experts" as defined by rules set forth by the SEC. During 2013, the Audit Committee met six times.

In the performance of its oversight function, the Audit Committee reviewed and letterdiscussed the Company’s audited financial statements for the year ended December 31, 2020 with the Company’s management and Deloitte. In addition, the Audit Committee discussed with Deloitte, with and without management present, Deloitte’s evaluation of the overall quality of the Company’s financial reporting. The Audit Committee also discussed with Deloitte the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the Securities and Exchange Commission. The Audit Committee also received the written disclosures and the letter from Deloitte required by applicable requirements of the Public Company Accounting Oversight Board regarding the independentDeloitte’s communications with the Audit Committee concerning independence and discussed with Deloitte its independence.

Based on the Audit Committee has discussed with BDO the matters in those written disclosures, as well as BDO’s independence from the CompanyCommittee’s review and its management. The Audit Committee has reviewed, met and discussed with BDO such other matters as are required to be discussed with the Committee by Auditing Standards No. 16, Communications with Audit Committees.

| Cynthia Russo (Chair) | |

| Douglas G. Rauch | |

| James C. Stoffel |

| 12 |

Transactions with Related Persons

The Board of Directors has adopted a discussionwritten “Related Party Transactions Policy & Procedure” (“Policy”), which provides that the Company will only enter into, ratify, or continue a related party transaction, when the Board, acting through the Nominating & Corporate Governance Committee, determines that the transaction is in the best interests of the quality, not justCompany and its stockholders. Pursuant to the acceptability,Policy, the Nominating and Corporate Governance Committee reviews and either approves or disapproves all transactions or relationships in which the Company or any of its subsidiaries: (i) is a party, (ii) the amount of the accounting principles,transaction exceeds or is expected to exceed $120,000, and (iii) in which a director (director nominee), executive officer, a person who beneficially owns more than 5% of our common stock, or any immediate family member or affiliated entity of any of the reasonablenessforegoing persons (a “related party”), has a direct or indirect interest.

Since the beginning of significant judgments,2020, there were no related person transactions proposed or required to be disclosed under Item 404 of Regulation S-K of the Exchange Act.

Security Ownership of Certain Beneficial Owners and Management

Stock Ownership of Directors and Officers

The tables below set forth, as of April 9, 2021, information regarding beneficial ownership of our common stock.

Beneficial ownership is determined according to the rules of the SEC and generally means that a person has beneficial ownership of our common stock if he, she, or it possesses sole or shared voting or investment power of the common stock or has the right to acquire beneficial ownership of our common stock within 60 days. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons named in the tables below have or will have sole voting and investment power with respect to all shares of common stock shown that they beneficially own, subject to community property laws where applicable.

Our calculation of the percentage of beneficial ownership is based on 24,315,060 shares of our common stock outstanding as of April 9, 2021. Common stock subject to stock options currently exercisable or exercisable within 60 days of April 9, 2021 is deemed to be outstanding for computing the percentage ownership of the person holding these options and the claritypercentage ownership of disclosuresany group of which the holder is a member but is not deemed outstanding for computing the percentage of any other person.

The table is based upon information supplied by officers, Directors and principal stockholders, Schedules 13D, 13G and 13G/A filed with the SEC and other SEC filings made pursuant to Section 16 of the Exchange Act.

The following table sets forth the beneficial ownership of our common stock as of April 9, 2021 by our (1) Directors, (2) named executive officers, and (3) our Directors and current executive officers as a group.

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | ||

| Directors | ||||

| Keith E. Pascal | 0(1) | * | ||

| Douglas G. Rauch | 14,171(2) | * | ||

| Cynthia A. Russo | 34,431(2) | * | ||

| John W. Sammon, Jr. | 1,225,784(3) | 5.0% | ||

| Savneet Singh | See holdings below | * | ||

| James C. Stoffel | 14,171(2) | * | ||

| Named Executive Officers | ||||

| Savneet Singh | 322,005(4) | 1.3% | ||

| Bryan A. Menar | 32,167(5) | * | ||

| Matthew R. Cicchinelli | 20,914(6) | * | ||

| All Directors and current executive officers as a group (8 persons) | 1,663,643 | 6.8% |

| 13 |

* Less than 1%

(1) Mr. Pascal joined the Company’s Board in April 2021 in connection with the purchase of 73,530 shares of common stock and the Warrant representing the right to purchase an additional 500,000 shares of common stock by Act III and disclaims any beneficial ownership of shares held by Act III, of which he is a member.

(2) Includes 3,446 unvested restricted stock units that vest on the earlier of June 4, 2021 and the date of the 2021 Annual Meeting.

(3) See footnote (6) to the “Stock Ownership of Certain Beneficial Owners” table below.

(4) Includes 239,583 shares subject to a currently exercisable stock option.

(5) Includes 28,418 shares subject to a currently exercisable stock option.

(6) Includes 3,470 shares subject to a currently exercisable stock option.

| 14 |

Stock Ownership of Certain Beneficial Owners

The following table provides information regarding the beneficial ownership of each person known by us to beneficially own more than 5% of our common stock.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | ||

T. Rowe Price Associates, Inc. 100 E. Pratt Street Baltimore, MD 21202 | 2,310,149(1) | 9.5% | ||

ADW Capital Partners, L.P. 1261 99th Street Bay Harbor Islands Florida 33154 | 2,100,200(2) | 8.6% | ||

Capital Research Global Investors South Hope Street 555th Fl Los Angeles, CA 90071 | 1,818,660(3) | 7.5% | ||

BlackRock, Inc. 55 East 52nd Street New York, NY 10055 | 1,602,752(4) | 6.6% | ||

Nine Ten Capital Management LLC 1603 Orrington Ave Ste 165 Evanston, IL 60201 | 1,442,024(5) | 5.9% | ||

John W. Sammon, Jr. c/o PAR Technology Corporation 8383 Seneca Turnpike New Hartford, NY 13413-4991 | 1,225,784 (6) | 5.0% |

(1) T. Rowe Price Associates, Inc. (“TRPA”) serves as investment adviser with power to direct investments and/or sole power to vote the securities owned by the funds and accounts, as well as securities owned by certain other individual and institutional investors. For purposes of reporting requirements of the Securities Exchange Act of 1934, TRPA may be deemed to be the beneficial owner of all of these shares; however, TRPA expressly disclaims that it is, in fact, the beneficial owner of such securities.

(3) Capital Research Global Investors has sole voting power and sole voting power with respect to 1,818,660 shares. This information has been obtained from a Schedule 13G filed by Capital Research Global Investors with the SEC on February 16, 2021.

(4) BlackRock, Inc. has sole voting power with respect to 1,545,314 shares and sole dispositive power with respect to 1,602,752 shares. This information has been obtained from a Schedule 13G filed by BlackRock, Inc. with the SEC on February 2, 2021.

(5) Nine Ten Capital Management LLC has sole voting power and sole dispositive power with respect to 1,442,024 shares. This information has been obtained from a Schedule 13G filed by Nine Ten Capital Management LLC with the SEC on February 12, 2021.

(6) Based on a Schedule 13G/A filed with the SEC on February 16, 2021 by John W. Sammon, Jr., Deanna D. Sammon, J.W. Sammon Corp. and Sammon Family Limited Partnership. Mr. Sammon reports sole voting power with respect to 1,205,064 shares, sole dispositive power with respect to 1,201,618 shares, and shared voting and dispositive power with his wife, Deanna D. Sammon with respect to 20,720 shares; this amount for Mr. Sammon includes 3,446 of restricted stock units that vest on the earlier of June 4, 2021 and the date of the 2021 Annual Meeting, and for which Mr. Sammon has voting, but not dispositive power. Mrs. Sammon reports having no shares over which she has sole voting and dispositive power and shared voting and shared dispositive power with her husband, Mr. Sammon, with respect to 20,720 shares. J.W. Sammon Corp. reports having no shares over which it has sole voting and dispositive power and shared voting and shared dispositive power with respect to 20,620 shares. Sammon Family Limited Partnership reports having no shares over which it has sole voting and dispositive power or shared voting and dispositive power. J.W. Sammon Corp. is the sole general partner of the Sammon Family Limited Partnership. Mr. and Mrs. Sammon are officers and 50% shareholders of J.W. Sammon Corp. Mrs. Sammon disclaims beneficial ownership of 1,205,064 shares beneficially owned by Mr. Sammon.

| 15 |

2020 Director Compensation

During 2020 compensation for non-employee Directors consisted of a mix of cash and equity. In February 2020, Pearl Meyer provided the Compensation Committee with an analysis of non-employee director compensation, including a review of director compensation of the Company’s peer group (the “Pearl Meyer Director Compensation Report”). The peer group for this analysis consisted of the same comparator group that is used to evaluate executive compensation and is described below in “Compensation Discussion and Analysis –Market Data and Considerations for Determining NEO Pay.”

Based on the Pearl Meyer Director Compensation Report, the Compensation Committee recommended to the Board of Directors that no adjustment was needed to the compensation structure for non-employee Directors as director pay approximated the median of the peer group. As a result, there was no year-over-year change in the consolidatedcash compensation component or equity compensation component of the non-employee Director compensation program. Our non-employee Directors do not receive additional fees for Board or committee meeting attendance. Our non-employee Directors received the following cash retainers for their service on the Board and committee membership, which are paid quarterly in arrears:

| Position | Cash Retainer (Board & Committee) | |

| Non-Employee Director | $40,000 | |

| Lead Director | $18,000 | |

| Audit Committee, Chair | $18,000 | |

| Audit Committee, Member | $ 9,000 | |

| Compensation Committee, Chair | $10,000 | |

| Compensation Committee, Member | $ 5,000 | |

| Nominating & Corporate Governance Committee, Chair | $ 7,500 | |

| Nominating & Corporate Governance Committee, Member | $ 3,750 |

Each non-employee Director received an annual award of restricted stock units having a grant date fair value of $90,000. The number of shares subject to the 2020 annual grant was based on the closing price of our common stock on June 4, 2020 ($26.11), the grant date, and resulted in a grant of 3,446 restricted stock units. These restricted stock units will vest on the earlier of June 4, 2021 and the date of the 2021 Annual Meeting, subject to continued service through that date. The 2020 grants were made under the Amended and Restated PAR Technology Corporation 2015 Equity Incentive Plan (the “2015 Equity Incentive Plan”). We also reimburse our non-employee Directors for reasonable expenses incurred to attend Board and Committee meetings.

In 2020 compensation earned by or paid to our non-employee Directors was as follows:

Name of Director | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($) (2) | All Other Compensation ($) | Total ($)(3) | ||||

| Douglas G. Rauch | 57,750 | 89,975 | - | 147,725 | ||||

| Cynthia A. Russo | 63,001 | 89,975 | - | 152,976 | ||||

| John W. Sammon | 36,250 | 89,975 | - | 126,225 | ||||

| James C. Stoffel | 77,001 | 89,975 | - | 166,976 |

(1) Compensation is pro-rated for the number of days served on the Board and in any particular role or committee, as applicable.

(2) This column includes the aggregate grant date fair value computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 (FASB ASC Topic 718) with respect to stock awards made to non-employee Directors in 2020. Assumptions made in the valuation are discussed in Note 11 to the Company’s 2020 Consolidated Financial Statements included in the Company’s Annual Report on 10-K filed with the SEC on May 16, 2021. Each non-employee director had 3,446 unvested restricted stock units outstanding at December 31, 2020 with the grant date fair value set forth in the column.

(3) In light of the impact of the COVID-19 pandemic and the Company’s implementation of temporary cost saving measures, each non-employee Director agreed to reduce the allocable portion of his or her $40,000 annual cash retainer for the fiscal quarter ending June 30, 2020 by 25%.

| 16 |

Stock Ownership Guidelines for Non-employee Directors

Directors are required to hold shares of the Company’s common stock with a fair market value equal to 3x the amount of the annual cash retainer payable to the non-employee Director. All shares of common stock bought by a non-employee Director or the Director’s immediate family member residing in the same household, all shares held in trust for the benefit of a non-employee Director or his or her family, and all shares granted under the 2015 Equity Incentive Plan count toward the satisfaction of these requirements. Each non-employee Director is required to attain such ownership within five (5) years of the later of: (a) the effective date of the policy (June 8, 2018) and (b) joining the Board.

| 17 |

Compensation Discussion and Analysis

The compensation discussion and analysis describes our executive compensation for fiscal year 2020, including the compensation for our named executive officers (or “NEOs”), and illustrates the objectives, elements and philosophy of our executive compensation program. Our named executive officers for fiscal year 2020 were:

NAME AND RESPECTIVE POSITIONS AND OFFICES | AGE | BIO | ||

Savneet Singh Chief Executive Officer and President of the Company and President of ParTech, Inc. | 37 | Mr. Singh joined the Company’s Board of Directors in April 2018 and has served as the Chief Executive Officer and President of the Company and President of ParTech, Inc., since March 2019. Mr. Singh previously served as the Interim Chief Executive Officer and President of the Company and Interim President of ParTech, Inc. from December 2018 until March 2019. Mr. Singh has been a partner of CoVenture, LLC, a multi-asset manager with funds in venture capital, direct lending, and crypto currency since June 2018. From 2017 - 2018, Mr. Singh served as the managing partner of Tera-Holdings, LLC, a holding company of niche software businesses that he co-founded. In 2009, Mr. Singh co-founded GBI, LLC (f/k/a Gold Bullion International, LLC (GBI)), an electronic platform that allows investors to buy, trade and store physical precious metals. During his tenure at GBI, from 2009 - 2017, Mr. Singh served as GBI’s chief operating officer, its chief executive officer, and its president. In August 2020, Mr. Singh joined the board of directors of Sharp Spring, Inc., a publicly traded technology provider of a cloud-based marketing automation platform (NASDAQ: SHSP). Since October 2019, Mr. Singh has served on the board of directors of Osprey Technology Acquisition Corp. (NYSE: SFTW.U), a blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination. Following the merger of Osprey Technology Acquisition Corp. with BlackSky Global, LLC, Mr. Singh will be resigning from his position as a director of Osprey. As an entrepreneur and investor in software companies, Mr. Singh brings unique insight and a strategic perspective to our software solutions business. | ||

Bryan Menar Chief Financial Officer and Vice President of the Company | 45 | Mr. Menar joined the Company as Chief Financial Officer and Vice President on January 3, 2017. From January 2015 to January 2017, Mr. Menar served as Vice President, Financial Planning and Analysis of Chobani, LLC, a producer of greek yogurt products based in central New York. In this role, Mr. Menar was responsible for corporate financial analysis, including forecasting, budgeting, business reviews and financial presentations for both internal and external stakeholders and partners. From October 2012 to December 2014, Mr. Menar served as Director of Financial Planning and Analysis for Chobani, LLC. In addition, Mr. Menar served as a consultant with J.C. Jones & Associates, a national business consulting firm, from 2010 to 2012, and as Vice President, Merchant Bank Controllers, of Goldman Sachs & Co. from 2002 - 2010. Mr. Menar is a Certified Public Accountant. | ||

Matthew R. Cicchinelli President of PAR Government Systems Corporation and Rome Research Corporation | 58 | Mr. Cicchinelli was named President of PAR Government Systems Corporation and Rome Research Corporation (together, “PAR Government”) effective December 12, 2015. Mr. Cicchinelli joined PAR Government in 2011 as Executive Director for Operations, and in 2013 was promoted to Vice President, Intelligence, Surveillance and Reconnaissance (“ISR”) Innovations. Prior to joining PAR Government, Mr. Cicchinelli served in various senior roles with the United States Marine Corps and the Department of Defense with a focus on command and control, ISR technologies, and strategic plans and policies. Mr. Cicchinelli retired from the Marine Corps in 2011 with the rank of Colonel. |

| 18 |

Overview of Executive Compensation

Compensation Objective

Our executive compensation program is built to drive the creation of stockholder value. The 2020 executive compensation program was designed to attract, retain and incentivize top performers in a highly competitive market for talent who can deliver competitive financial statements)returns for our stockholders through the achievement of short-term and long-term goals. To achieve this, we maintain:

| · | Pay for Performance. Our short-term (annual performance based, cash bonus (“STI”)) and long-term (equity awards (“LTI”)) incentive programs create a strong relationship between compensation and performance. Payment of annual STI bonuses is tied to achievement of Company financial performance metrics, and individual performance against key performance indicators and behaviors that reinforce the values of leadership, integrity, speed, accountability, teamwork, innovation and quality on an annual basis, while LTI equity awards are granted with the intent to reward longer term goals and vesting is dependent on the performance of our common stock; and |

| · | Competitive Compensation. We provide compensation opportunities that take into account compensation levels and practices of our peers, but without targeting any specific percentile of relative compensation; instead, our compensation programs are designed to reward top performers in a highly competitive market for talent and align their interests with the interests of our stockholders. |

2020 Highlights

In February 2020, we entered into a new employment agreement with Savneet Singh for his continued service as CEO and President of the Company and President of ParTech, Inc., which was amended in February 2021. In July 2020, Matthew Cicchinelli and PAR Government entered into a new employment agreement pursuant to which Mr. Cicchinelli continues to serve as the President of PAR Government. The employment agreements for both Mr. Singh and Mr. Cicchinelli are described in further detail in “Compensation Discussion and Analysis –Employment Arrangements in effect for 2020.”

COVID-19 Impact

In early 2020, the COVID-19 pandemic presented a number of novel and unprecedented financial and operational challenges and created uncertainty and disruption to our employees and business. In response to those challenges, early in the second quarter of 2020, we implemented a number of cost saving measures to mitigate the impact of COVID-19 on our employees and business, including reductions in discretionary spending, a non-essential position hiring freeze, a reduction in workforce and employee furloughs. We also made temporary adjustments to the base salaries of certain of our employees (the “Temporary Salary Reduction Program”), including the base salaries of our CEO and CFO.

By March 2020, management was actively monitoring the impacts of the COVID‐19 pandemic on our Restaurant/Retail business and providing reports to our Compensation Committee, including advising the Committee on the potential impact of the pandemic on the Company’s previously established 2020 annual operating plan (“Actual AOP”). To assist the Compensation Committee in its monitoring of the COVID-19 pandemic’s impact on our business, management provided the Compensation Committee with an alternative annual operating plan, which tracked the impact and potential impact of the COVID‐19 pandemic on our business (the “COVID‐19 AOP”). Referencing the COVID‐19 AOP, and measuring the Company’s performance against Actual AOP and the COVID‐19 AOP and other factors, the Compensation Committee continuously assessed the Company’s performance and evaluated whether it was prudent to adjust the framework and/or performance metrics of the Company’s incentive programs in consideration of the continued uncertainty of the COVID‐19 pandemic and the difficulty in establishing new performance metrics in light of such uncertainties. The Compensation Committee ultimately determined in September 2020 that it would not adjust the performance metrics of the Company’s incentive programs, but instead would evaluate the Company’s performance following the end of 2020 and, based on the Company’s 2020 performance, including against the backdrop of the COVID‐19 pandemic, determine whether to use its discretionary authority to grant short‐term and long‐term incentive payouts. Because of the negligible impact of the COVID‐19 pandemic on PAR Government, the Compensation Committee determined that no changes would be made to the Company’s incentive compensation programs as they related to PAR Government’s management.

| 19 |

Role of the Compensation Committee and CEO

The Compensation Committee approves the annual compensation of our NEOs and certain other senior officers of the Company, including incentive compensation (cash and equity based). Our CEO provides information and recommendations to the Compensation Committee on the compensation and performance of our other NEOs, including recommendations as to the appropriate levels of base salaries, short-term incentive compensation and long-term equity awards, performance targets for corporate and other operating segments, and individual performance targets.

With respect to the compensation of the CEO, the Compensation Committee worked directly with Pearl Meyer to develop the compensation program for the CEO. The CEO does not make recommendations on his base salary or the mix and/or structure of his short-term cash incentive or long-term equity incentive compensation.

Role of Compensation Consultant

The Compensation Committee engaged Pearl Meyer as its consultant to provide information and advice concerning executive and non-employee director compensation. The Compensation Committee believes that Pearl Meyer has the necessary skills, knowledge, industry expertise, and experience, as well as the necessary resources, to provide a comprehensive approach to executive and non-employee director compensation analysis, planning and strategy. Pearl Meyer provides advice related to executive and non-employee director compensation as requested, including an annual analysis of executive and non-employee director compensation compared to peer company practice and data. Pearl Meyer may also provide input on management materials and recommendations in advance of Compensation Committee meetings, as well as assisting in the review of the compensation discussion and analysis.

| 20 |

In late 2019, Pearl Meyer conducted an executive compensation study and provided the Compensation Committee with an analysis of our executive compensation and program design for 2020, including comparator peer group compensation data for our NEOs and other back-up information and analysis of compensation matters as requested by the Compensation Committee.

Market Data and Considerations for Determining NEO Pay

In response to our Compensation Committee’s request that Pearl Meyer perform an assessment of our executive compensation, including a peer group and survey data, Pearl Meyer provided our Compensation Committee with both peer group data and compensation survey data specific to technology companies. The 2020 peer group focused on size and industry-relevant companies taking into account revenue, number of employees and market capitalization. The 2020 peer group included the following companies:

| Peer Group | ||

| A10 Networks, Inc. | Agilysys, Inc. | American Software, Inc. |

| Bottomline Technologies, Inc. | Digi International Inc. | eGain Corporation |

| Frequency Electronics, Inc. | i3 Verticals, Inc. | Iteris, Inc. |

| KVH Industries, Inc. | PowerFleet, Inc. | PROS Holdings, Inc. |

| QAD Inc. | SPS Commerce, Inc. | TESSCO Technologies Incorporated |

| Upland Software, Inc. | ||

In addition to competitive analysis data, including the market trend data about the impact of the COVID-19 pandemic, the Compensation Committee considered each NEO’s individual expertise, skills, responsibilities, required commitment, current and anticipated contribution to the Company’s achievement of its plans and goals, as well as prior compensation adjustments, prior award accumulation, and any contractual commitments, in formulating the 2020 compensation of our NEOs.

2020 NEO Compensation Design

Our 2020 executive compensation program was designed to retain and motivate our NEOs, and to promote the creation and delivery of stockholder value by incentivizing our NEOs to deliver competitive financial returns by establishing performance targets linked to our financial and business goals and objectives. In 2020, we compensated our NEOs primarily through a combination of base salary and incentive compensation, which has a short-term cash component (“STI”) and a long-term equity component (“LTI”) based on the Company’s performance. Despite the COVID‐19 pandemic, the Company performed well in 2020, and the Compensation Committee determined it appropriate to use its discretion and adjust the incentive compensation components of our NEO’s compensation.

Base Salary. We use base salary to provide a fixed level of cash compensation to reward demonstrated experience, skills and competencies relative to the market value of the job and impact of the individual on the business and organization. Adjustments to base salary are considered periodically, but are not guaranteed, based on individual performance, level of pay relative to the market and internal pay equity. In setting the annual base salary of our CEO, and in reviewing and approving the annual base salaries of the other NEOs, the Compensation Committee considered information from Pearl Meyer and other factors described above under “Compensation Discussion and Analysis –Market Data and Considerations for Determining NEO Pay”.

Mr. Singh’s base salary was increased to $550,000 pursuant to his February 27, 2020 employment agreement, and Mr. Menar received an increase in his base salary in mid-2020 to $284,550 in recognition of his performance in 2019 and continued contributions to the Company. On January 11, 2020, Mr. Cicchinelli’s base salary was increased to $259,350 in recognition of his contributions to PAR Government in 2019.

Pursuant to the Temporary Salary Reduction Program, from April 11, 2020 to July 3, 2020, Mr. Singh’s base salary was temporarily reduced by 25% and Mr. Menar’s base salary was temporarily reduced by 20%; and, (b) management'sbeginning July 4, 2020, the temporary salary reduction was lowered to 12.5% of Mr. Singh’s base salary and 10% of Mr. Menar’s base salary. On September 12, 2020, the base salaries of Messrs. Singh and Menar were reinstated to their pre-reduced base salary levels. The impact of the Temporary Salary Reduction Program on the base salaries of our NEOs in 2020 is illustrated below.

| 21 |

| NEO | Date Range | Base Salary | Reason for Change | |||

| Savneet Singh | January 1, 2020 – February 26, 2020 | $490,000 | ||||

| February 27, 2020 – April 10, 2020 | $550,000 | New employment contract | ||||

| April 11, 2020 – July 3, 2020 | $412,500 | Salary reduction of 25% under the Temporary Salary Reduction Program | ||||

| July 4, 2020 – September 11, 2020 | $481,250 | Salary reduction of 12.5% under the Temporary Salary Reduction Program | ||||

| September 12, 2020 – December 31, 2020 | $550,000 | Salary reinstated | ||||

| Annualized 2020 Salary | $493,510 | |||||

| Bryan Menar | January 1, 2020 – April 10, 2020 | $271,000 | ||||

| April 11, 2020 – July 3, 2020 | $216,800 | Salary reduction of 20% under the Temporary Salary Reduction Program | ||||

| July 4, 2020 – September 11, 2020(1) | $256,095 | Salary reduction of 10% under the Temporary Salary Reduction Program | ||||

| September 12, 2020 – December 31, 2020 | $284,550 | Salary reinstated | ||||

| Annualized 2020 Salary | $259,274 | |||||

| Matthew Cicchinelli(2) | January 1, 2020 – January 10, 2020 | $247,000 | ||||

| January 11, 2020 – December 31, 2020 | $259,350 | Salary increased applied for 2020 | ||||

| Annualized 2020 Salary | $268,138 |